Back to blog

Back to blog

EOFY 2018 – Tax Savings on Machine Purchases

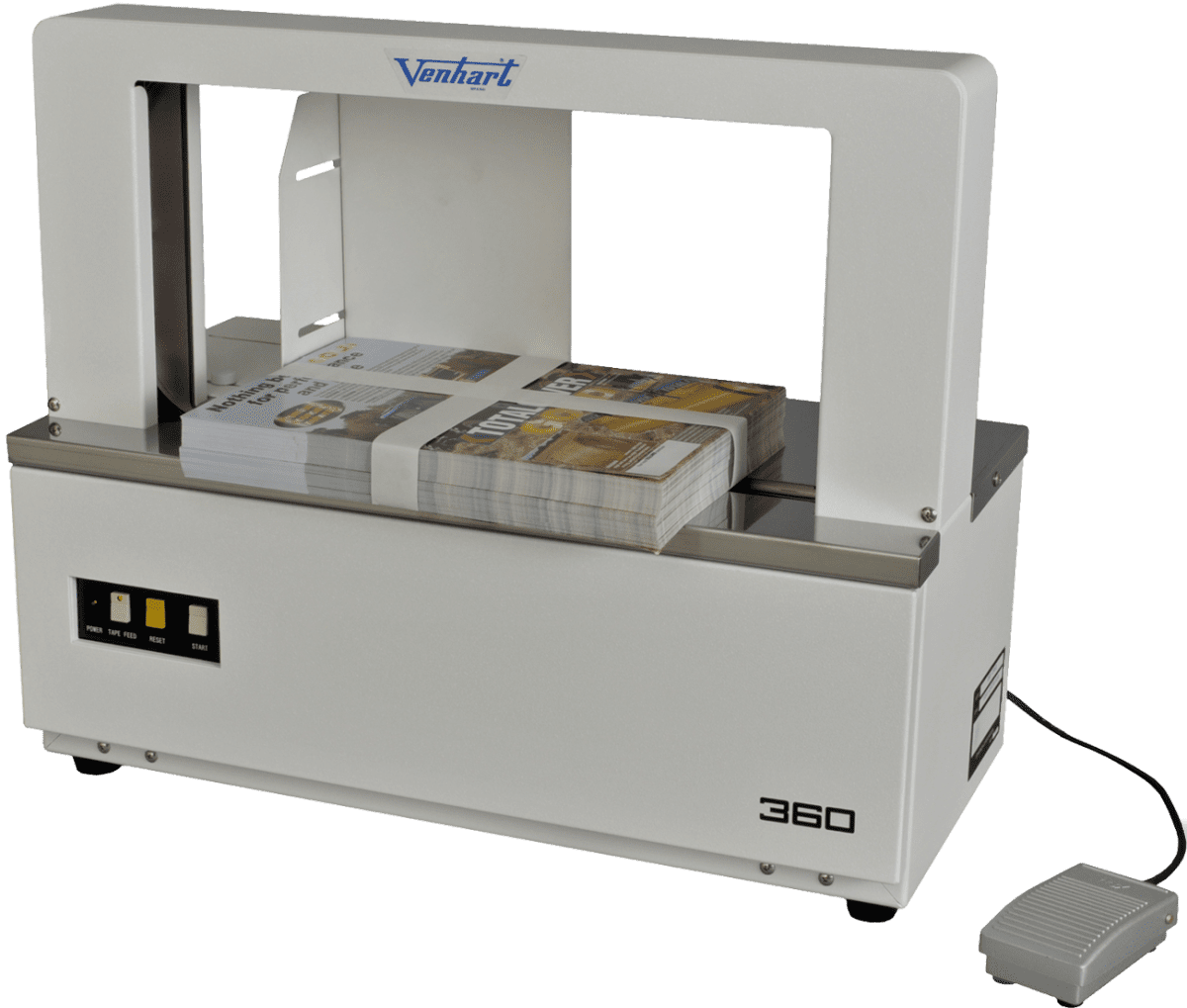

Small businesses with a turnover of less than $10 million would be aware of the instant write-off for assets under $20,000 purchased for business use. Eligible businesses can buy equipment related to their operations, and as long as each item is less than $20,000, they can claim an immediate tax deduction.

If you’re ready to upgrade from a manual packing process to a semi, or fully automatic process then perhaps this is now the right time. Please check our website for packaging options or contact us to discuss your operational needs, venus@venuspacking.previewsite.com.au.

Please seek independent tax advice for your business.